For many small to medium-sized enterprises (SMEs), the end of the month brings a familiar dread: a mountain of receipts, scattered PDF invoices, and a spreadsheet that refuses to balance. Financial management shouldn't be a nightmare—it should be a strategic advantage. Enter Invoice Parse, the all-in-one SaaS solution designed to automate the heavy lifting of finance, from capturing data to the final bank reconciliation.

From Chaos to Clarity: Why Invoice Parse is the Financial Copilot Every SME Needs

Running a business is about growth, strategy, and innovation. Yet, for countless small and medium-sized companies, valuable hours are lost every week to the manual drudgery of financial administration. If you are still manually typing data from PDFs into Excel or chasing employees for crumpled receipts, you are living in a financial nightmare. It is time to wake up to the power of automation.

The All-In-One Platform for Modern Finance

Invoice Parse is not just another storage folder for your documents. It is a dynamic, intelligent ecosystem built (using the robust Django framework) to handle the entire lifecycle of a transaction. Whether you are a solo founder or a finance team of ten, our goal is simple: transform disjointed data into actionable financial intelligence.

1. Seamless Ingestion: Web & Mobile

Invoices arrive from everywhere—email attachments, vendor portals, and physical receipts from business lunches. Invoice Parse consolidates these streams.

- Snap & Go: Use our responsive mobile app to snap a photo of a receipt the moment you get it.

- Web Uploads: Drag and drop batches of digital invoices directly into the browser.

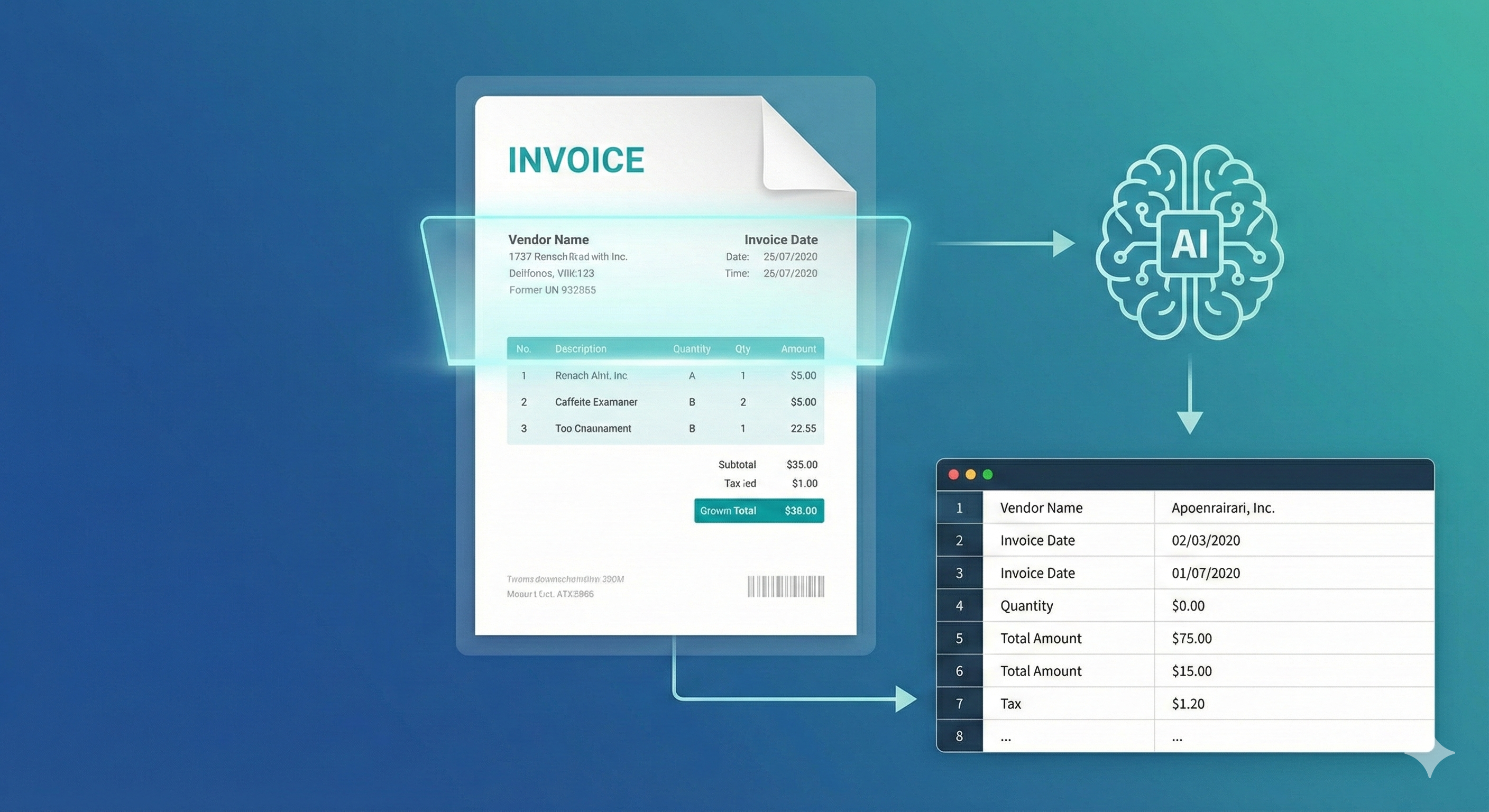

2. AI-Powered Parsing & Structured Data

The magic happens the moment a document hits our servers. Instead of relying on rigid templates, Invoice Parse utilizes advanced algorithms to read your invoices like a human would—but faster and without errors. We extract key elements (Vendor, Date, Line Items, Tax, Total Amount) and convert them into structured data. This means your "PDF" is now a searchable, filterable database record.

3. Corporate Validation & Stakeholder Sharing

Finance is a team sport. Once data is parsed, Invoice Parse facilitates seamless collaboration across your stakeholders.

Need a manager's approval for a specific expense? The platform handles routing and corporate validations automatically. You can set rules to flag anomalies, ensuring compliance before a single cent leaves the bank account.

4. "Ask AI": Your Financial Analyst

Imagine having a financial analyst sitting next to you, ready to answer any question instantly. With our "Get Insights" feature, you can literally ask the platform questions about your data:

"How much did we spend on software subscriptions last quarter?"

"Show me all invoices from Vendor X pending approval."

Invoice Parse provides immediate answers, turning raw data into strategic oversight.

5. Out-of-the-Box Bank Reconciliation

The most painful part of accounting is matching the invoice to the bank transaction. We have solved it. By integrating your bank feed with our parsed invoice data, Invoice Parse performs automatic reconciliation at the end of the month. We match the payments to the bills, highlighting only the discrepancies that require your attention.

Conclusion

Built with stability and speed in mind, Invoice Parse is the tool all small to medium companies should be using to stay competitive. Stop treating financial management as a necessary evil and start treating it as an automated workflow.

Ready to transform your financial nightmare into a dream? Try Invoice Parse today.