Invoice Parse started by eliminating the manual work of extracting invoice data. Now, it goes further—adding intelligent bank reconciliation to help accounting teams connect transactions to supporting documents faster, with less effort and more control.

From Invoice Capture to Full Financial Intelligence: Introducing AI-Powered Bank Reconciliation

For most businesses, the biggest time sink in finance operations is not the lack of data—it’s the effort required to connect it. Invoices arrive in different formats, bank transactions contain short descriptions, and month-end closing becomes a repetitive exercise of searching, comparing, and validating. This is where modern financial operations need more than digitization. They need intelligence.

Invoice Parse was built to remove friction from invoice handling by capturing invoice information automatically and making it ready for accounting workflows. Today, we are expanding that value with a new capability: AI-powered bank reconciliation, designed to reduce the time spent matching transactions to invoices and supporting documents—without adding complexity to your process.

Why Bank Reconciliation Still Slows Teams Down

Bank reconciliation is essential for accurate financial reporting, cash visibility, and compliance. Yet, it often remains highly manual. Teams typically rely on a mix of bank exports, spreadsheets, email searches, invoice folders, and institutional knowledge to understand what each transaction represents.

The challenge is not only volume—it’s ambiguity. Bank transaction descriptions are often shortened, inconsistent, or filled with references that make sense only to the bank. Meanwhile, the invoice you need might be in a different system, shared by a supplier in an email thread, or stored under a slightly different name. The result is a process that is slow, error-prone, and difficult to scale.

What “Intelligent Reconciliation” Means in Practice

Intelligent reconciliation goes beyond simply displaying bank lines. It helps interpret them. The goal is to support accounting and finance teams with a practical assistant that speeds up the review process while keeping decisions in human hands.

With AI-powered bank reconciliation, Invoice Parse can analyze bank statement entries and provide matching intelligence that helps you:

- Identify transaction entries that look like real business movements (and ignore irrelevant statement content).

- Recognize patterns in merchant names, references, and payment descriptions.

- Suggest likely matches between a bank movement and its supporting invoice or expense document.

- Reduce repetitive searching across folders and systems during month-end closing.

This means less time spent on manual matching and more time focused on validation, exception handling, and financial decision-making.

From Invoice Capture to a Broader Finance Workflow

Many teams first adopt invoice automation because it solves an obvious pain: invoice data entry. But over time, a bigger opportunity becomes clear—connecting invoices to the broader financial workflow, including payments and bank movements.

This evolution is natural. Once invoice data is captured and structured, it becomes much easier to link it to the real-world cash activity visible in bank statements. That connection is the foundation of stronger financial controls and faster operations.

Operational Benefits for Businesses and Accounting Teams

Intelligent reconciliation is not about replacing accounting practices—it’s about strengthening them by reducing the manual workload that slows teams down. The impact is measurable:

- Faster month-end closing: reduce time spent searching for documents and verifying entries.

- Higher accuracy: fewer missed matches and reduced risk of misclassification.

- Better audit readiness: clearer linkage between transactions and supporting documentation.

- Improved cash visibility: quicker understanding of outgoing payments and incoming receipts.

- Scalable processes: consistent reconciliation workflows as transaction volume grows.

Designed for Control and Practical Adoption

Finance teams need tools that support their process—not tools that force a new one. The approach behind Invoice Parse is to deliver out-of-the-box intelligence while keeping review and approval under your control.

Intelligent suggestions are there to accelerate your work, not to make decisions on your behalf. The result is a workflow that feels familiar, but dramatically more efficient.

Preview Now, Grow With It

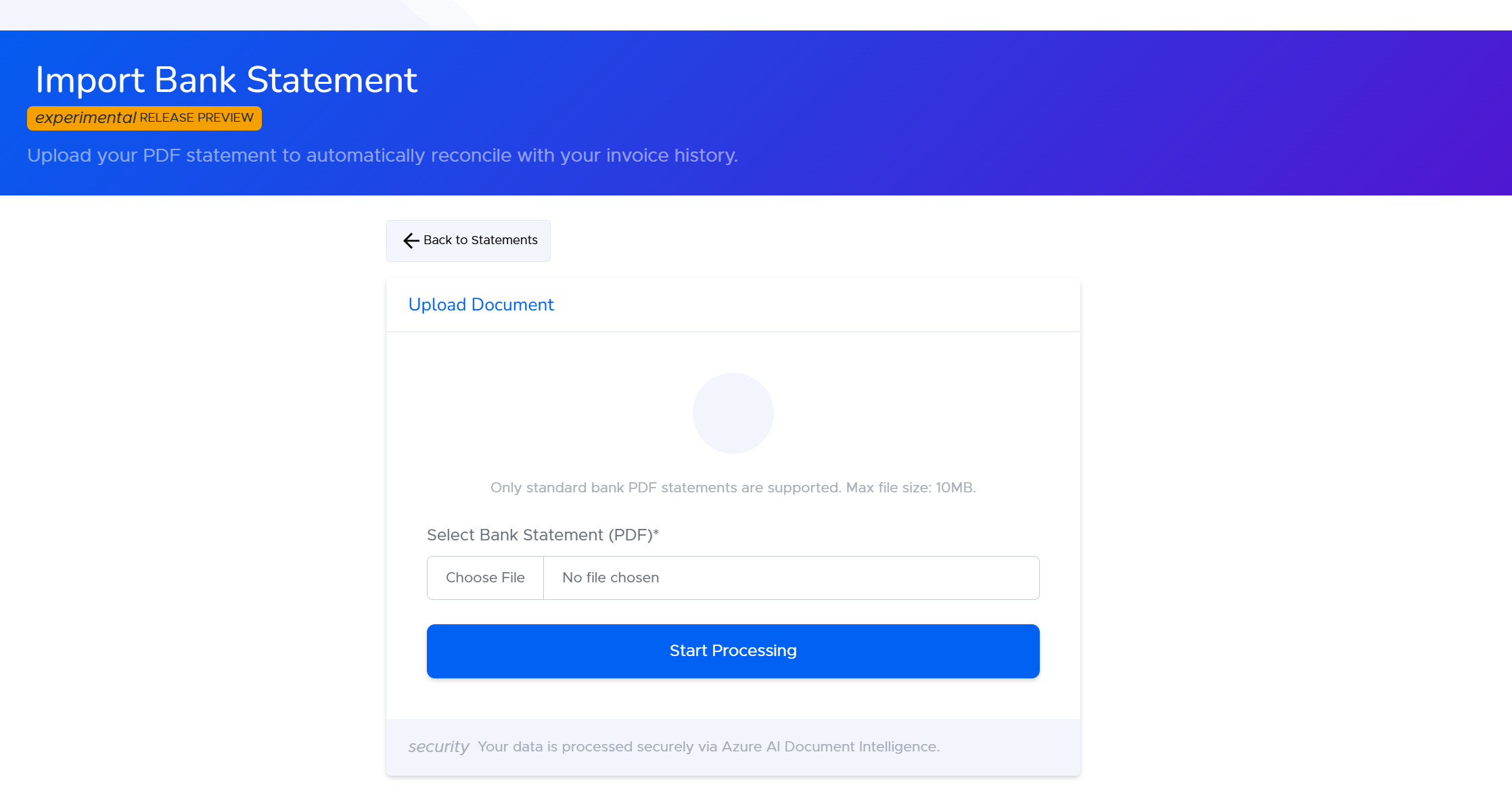

This feature is now live for preview. If you already use Invoice Parse for invoice capture, bank reconciliation becomes the next step toward a more complete financial intelligence workflow—connecting invoices, payments, and bank movements in one consistent process.

The future of finance operations belongs to businesses that reduce manual effort, increase consistency, and gain clarity faster. Invoice Parse is evolving to support that future—starting with intelligent invoice capture and expanding into reconciliation as part of a broader, smarter accounting workflow.